Meridian tax technology solutions for SAP automate SAP tax determination and compliance. We solve known limitations and shortcomings concerning VAT in SAP

Challenges for managing VAT in SAP

-

1

Staff and resources

Significant hours devoted to checking and validating transactional data.

-

2

Customised reports

The need to develop bespoke reports either to correct errors or format VAT-return data according to each tax authority’s requirements.

-

3

VAT compliance risks

VAT compliance risk associated with errors, omissions and disclosure discrepancies stemming from underlying SAP transactional data.

Meridian Tax Technology Solutions

ARCO Determination

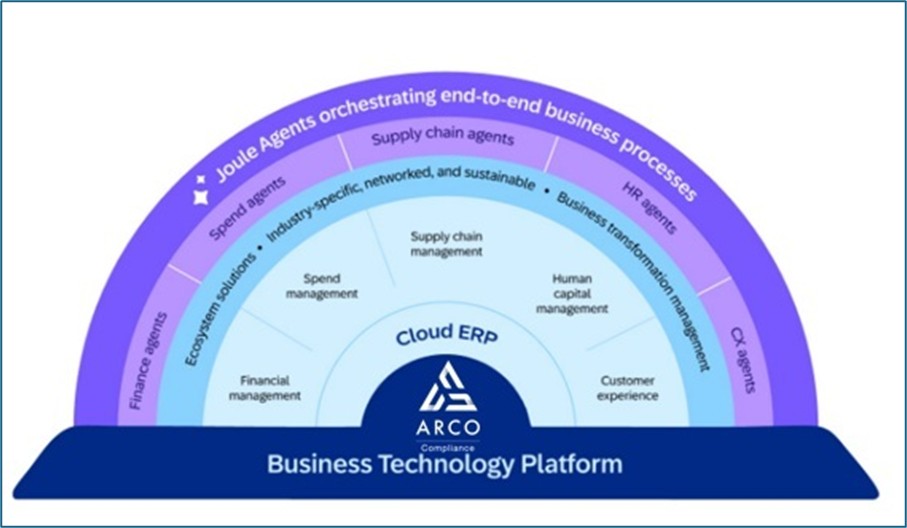

The ARCO application runs on the SAP Business Technology Platform and enhances functionality of standard SAP for global VAT determination.

ARCO Compliance

ARCO Compliance integrates directly with SAP to streamline the process of managing Global VAT. Built on over 20 years experience of managing VAT compliance in SAP.

VAT Add-on

The VAT Add-on is an on-premise tax determination solution and is built directly into native SAP, and overcomes all shortcomings in SAP VAT determination.

Vantage

Vantage is Meridian's Service package that ensures your system is always available and meeting business requirements. Includes a comprehensive product information hub.